How They Apply To Your Investments

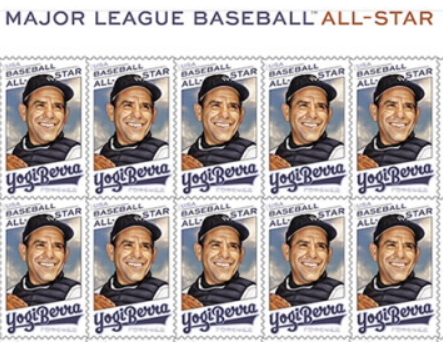

Earlier this summer, the US Postal Service announced that Yogi Berra, the legendary Yankees catcher, would be given his own postage stamp.1 It’s a tremendous honor, as Yogi is only the thirtieth baseball player in history to have his face on a stamp…and the USPS receives approximately 30,000 proposals with new stamp ideas each year.2

Besides being a Hall of Famer, Yogi was also an American hero, serving courageously as a Navy gunner during the Normandy landings. But these days, he’s probably best remembered for his “Yogi-isms”. His pithy, off-the-cuff sayings combined wisdom with humor, delivered in the form of irony, malapropisms, and oxymorons.

But Yogi-isms aren’t just funny. They contain genuine insights – and they often illustrate the core principles of sound investment planning surprisingly well!

So, in honor of Yogi Berra and his new stamp, I thought it would be fun to show you a few famous Yogi-isms and how they apply to your investments. Let’s start off with…

“A nickel ain’t worth a dime anymore.”

I don’t know what Yogi was lamenting when he said this, but it serves as a useful reminder of the hard reality of inflation. What costs a nickel at the beginning of retirement will likely cost a dime near the end. Many retirees make the mistake of forgetting to calculate for inflation when they plan for retirement, but it’s something you must consider. It’s also why you can’t just stick your money into a savings account or rely solely on ultra-conservative investments your whole life. The most successful retirees invest to have the money they need for every single inning. Some innings are better, some are worse, but it’s the scoreboard at the end of 9 that matters.

“Ninety percent of this game is half mental.”

Yogi was talking about baseball, but this equally applies to investing. You don’t need to already have millions to be a successful investor. You just need to have mental discipline. The discipline required to not abandon your long-term plan by chasing short-term wants. The discipline to not let greed lead you into overly risky investments. The discipline to not let fear stop you from investing at all. The discipline to not blindly follow the herd and make decisions just because “everyone else is doing it” or because some guru on TV says so.

Speaking of following the crowd…

“Nobody goes there anymore. It’s too crowded.”

Yogi was referring to why he never went to a popular restaurant in St. Louis, but boy if this doesn’t ever refer to

the stock market, too!

Too many investors are always chasing after the latest “hot stock” or investment trend. But here’s a funny thing about investing: By the time an investment becomes popular, the opportunity is often already gone. The “smart money” has already moved on to the “next big thing”, leaving the rest to keep playing catch-up. This is why too many investors sell low and buy high, when they want to be doing the opposite.

Instead of chasing after unicorns and rainbows, it’s better to simply identify a long-term investment strategy that fits your needs and goals…and then stick to it!

“It ain’t over till it’s over.”

People don’t stop changing, learning, and growing when they retire. Neither should your money.

Many people invest as if retirement is the finish line. It isn’t. With life expectancies longer than ever, it’s critical that you don’t invest just to have enough money for retirement. You must have enough money in retirement. The possibility of outliving their money is a very real concern for many retirees. That’s why your retirement plan should factor in how to keep growing your money long after you’ve stopped working.

“If you don’t know where you’re going, you’ll end up somewhere else.”

This Yogi-ism is probably the simplest, and most powerful, of all.

As both a player and a manager, Yogi always had a gameplan. If you have financial goals you want to achieve, you must have a gameplan, too. Investing without a plan is like running the bases with a blindfold on. You’ll be hoping to arrive at home base…only to run smack into the outfield wall instead. A proper plan, meanwhile, will help you know how much you need to meet expenses and reach your goals. It will help you know where that money can and should come from. It will help you choose investments that are right for you, not someone else. It will help you know what to do when the markets are up, and when they’re down. It will help you know when it’s time to swing for the fences and when it’s time to simply get on base.

It will help you know exactly where you’re going…and how to get there!

I hope you’ve enjoyed these Yogi-isms. But before I put the last period on this message, I’ll leave you with a final one:

“When you come to a fork in the road…take it!”