Is Your Financial Future Protected? – Part 2

Last week I shared that I have had clients affected by cyber identity theft, phone scams, and phishing – and that I would share how to protect yourself and your finances from hackers, scammers, and identity theft.

Lets get started with…

IDENTITY THEFT

“People need to be more aware and educated about identity theft. You need to be a little bit wiser, a little bit smarter, and there’s nothing wrong with being skeptical. We live in a time when if you make it easy for someone to steal from you, someone will.” ~ Frank Abagnale, former con-man and subject of the movie Catch Me If You Can.

Identity theft is “the deliberate use of someone else’s identity, usually as a method to gain a financial advantage or obtain credit and other benefits in the other person’s name.”

Usually, identity thieves are looking to apply for a loan, get medical services, or receive a tax refund in your name. Or, they may be hoping to go on an online shopping spree using your credit card. Either way, while identity theft may not be as shocking as, say, burglary, it can be equally devastating — and even more time-consuming to recover from.

The good news is that protecting yourself from identity theft isn’t hard. It simply requires you to be proactive and vigilant when it comes to your finances. Click below to learn about some common forms of identity theft, who is most vulnerable, and how to spot the warning signs. You’ll also learn simple-but-effective steps for protecting yourself and your loved ones.

COMMON FORMS OF IDENTITY THEFT

Oftentimes, we only think of getting our identities stolen when we hear about a massive data breach — think Target in 2013 or Equifax in 2017.

But there are many ways that thieves can steal and exploit a person’s personal information.

A few of the most common techniques are:

Dumpster diving – Rummaging through garbage and recycling cans to find documents containing personal information like bills, medical forms, and statements.

Dumpster diving – Rummaging through garbage and recycling cans to find documents containing personal information like bills, medical forms, and statements.

Mail theft – One of the oldest forms of identity theft, mail theft is when a thief steals your mail looking for checks or documents that list your contact info, Social Security number, or credit card/bank information.

Mail theft – One of the oldest forms of identity theft, mail theft is when a thief steals your mail looking for checks or documents that list your contact info, Social Security number, or credit card/bank information.

Online shopping – Online merchants often require customers to set up accounts. This makes shopping convenient, but these accounts contain everything thieves need to use your money…and they’re often protected by weak, overused passwords that are easy to guess.

Online shopping – Online merchants often require customers to set up accounts. This makes shopping convenient, but these accounts contain everything thieves need to use your money…and they’re often protected by weak, overused passwords that are easy to guess.

Phishing – Ever receive an email or phone call from someone that looks or sounds legitimate, but isn’t? It could be a phishing attempt, where thieves try to “fish” for personal information by posing as your bank, the government, or some other authority.

Phishing – Ever receive an email or phone call from someone that looks or sounds legitimate, but isn’t? It could be a phishing attempt, where thieves try to “fish” for personal information by posing as your bank, the government, or some other authority.

Malware – Malicious software like worms, Trojan horses, spyware, and ransomware can give hackers access to your personal information, including passwords.

Malware – Malicious software like worms, Trojan horses, spyware, and ransomware can give hackers access to your personal information, including passwords.

WHO IS MOST VULNERABLE

WHO IS MOST VULNERABLE – By state

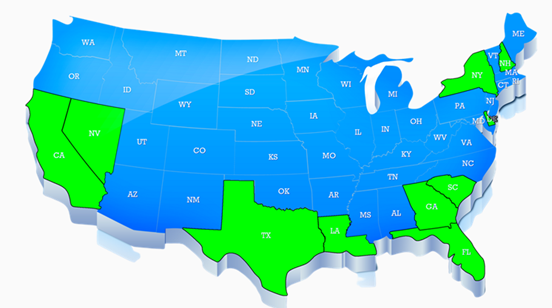

Identity theft is a threat to every American’s finances, regardless of who they are or where they live. But some people are more at risk than others. For example, these ten states have the highest rates of identity theft per 100,000 residents.

- CALIFORNIA

- NEVADA

- NEW HAMPSHIRE

- SOUTH CAROLINA

- DELAWARE

- LOUISIANA

- TEXAS

- NEW YORK

- FLORIDA

- GEORGIA

SOURCE: WalletHub

WHO IS MOST VULNERABLE – By demographic

Certain demographics may also be more vulnerable to identity theft, either because they represent potentially easy targets, or because they have exactly what identity thieves are looking for. If you or a loved one fall into one of these groups, it’s worth taking extra steps to protect yourself.

CHILDREN AND TEENS – Children are vulnerable to identity theft because their Social Security numbers are “clean” of any credit card applications, job history, mortgages, etc. Furthermore, parents often fail to check their child’s credit score, so theft can go undetected for a long time.

CHILDREN AND TEENS – Children are vulnerable to identity theft because their Social Security numbers are “clean” of any credit card applications, job history, mortgages, etc. Furthermore, parents often fail to check their child’s credit score, so theft can go undetected for a long time.

HIGH-INCOME EARNERS – Adults who earn a high income are often targets precisely because they have so much money! In addition, high-income earners may have financial data exposed in more places than others. (Think banks, brokerages, credit card companies, etc.)

HIGH-INCOME EARNERS – Adults who earn a high income are often targets precisely because they have so much money! In addition, high-income earners may have financial data exposed in more places than others. (Think banks, brokerages, credit card companies, etc.)

THE ELDERLY – The elderly tend to be targets because they may not be as internet-savvy as younger demographics, they often have a good deal in savings, and they may depend on caretakers (a dishonest caretaker has ample opportunity to steal information).

THE ELDERLY – The elderly tend to be targets because they may not be as internet-savvy as younger demographics, they often have a good deal in savings, and they may depend on caretakers (a dishonest caretaker has ample opportunity to steal information).

HOW TO SPOT THE WARNING SIGNS

HOW TO KNOW IF YOU’RE A VICTIM OF IDENTITY THEFT

Many victims do not even realize their identity has been stolen until months or even years later. Here are some indicators that you may have been targeted.

SUSPICIOUS ACTIVITY – Often, the first indicator of identity theft is if there is suspicious activity related to your credit or debit cards. For example, charges for goods or services you never ordered, receiving cards you didn’t apply for, or getting a call from your credit card company asking about unusual purchases are all major red flags. For these reasons, you should inspect your bank accounts and credit card transactions frequently.

SUSPICIOUS ACTIVITY – Often, the first indicator of identity theft is if there is suspicious activity related to your credit or debit cards. For example, charges for goods or services you never ordered, receiving cards you didn’t apply for, or getting a call from your credit card company asking about unusual purchases are all major red flags. For these reasons, you should inspect your bank accounts and credit card transactions frequently.

CREDIT SCORE – Your credit score can also serve as an early- warning indicator of identity theft. If your credit score has suddenly changed, or if you receive notification that your score was recently investigated, it could be a sign that thieves have either stolen your credit cards or applied for loans in your name.

CREDIT SCORE – Your credit score can also serve as an early- warning indicator of identity theft. If your credit score has suddenly changed, or if you receive notification that your score was recently investigated, it could be a sign that thieves have either stolen your credit cards or applied for loans in your name.

UNEXPECTED EVENTS – Whenever something unexpected happens with your money, it should make you sit up and take notice. In this case, any sudden changes to your bills, unusual data on your tax returns, or even a check unexpectedly bouncing are all potential symptoms of identity theft.

UNEXPECTED EVENTS – Whenever something unexpected happens with your money, it should make you sit up and take notice. In this case, any sudden changes to your bills, unusual data on your tax returns, or even a check unexpectedly bouncing are all potential symptoms of identity theft.

WHAT TO DO IF YOU SUSPECT YOUR IDENTITY HAS BEEN STOLEN

If you think your identity has been stolen, the first thing to do is take a deep breath. Dealing with identity theft isn’t fun, but it’s not the end of the world! With some patience and persistence, you WILL be able to recover your identity.

Next call my office right away. Let us know what happened. We will do everything in our power to assist you!

From there, the situation will require you to be methodical and thorough. The Federal Trade Commission (FTC) has listed some useful steps on what to do if your identity is stolen. I’ve listed the basic steps below, but you can read more about each by visiting the FTC website.

- Step #1: Call any companies where you know fraud occurred – ask to speak to the company’s fraud department if it has one. Explain that your identity was stolen, and request that your account(s) be frozen or closed. Then, change any logins, passwords, or PINs you have for those accounts. That way, no new charges can be added without your knowledge.

- Step #2: Place a fraud alert with one of the three main credit bureaus – contact one of the main credit bureaus: Experian, TransUnion, and Equifax. Ask for a free credit report so you can better monitor your credit score, and then place a free, one-year fraud alert. This makes it harder for someone to open new accounts in your name. NOTE: It doesn’t matter which bureau you choose, as each is legally required to inform the other two.

- Step #3: Report the theft of your identity to the Federal Trade Commission (FTC) – the FTC will help you create an Identity Theft Report and recovery plan. The report proves to businesses that your identity has been stolen and guarantees you certain rights. To create your report, fill out the online form here.

- Step #4: Close fraudulent accounts and remove bogus charges – once you have your Identity Theft Report, call the fraud departments of each business where an account was opened or money was spent. Again, ask that all accounts be closed and bogus charges canceled. Give a copy of the Identity Theft Report if necessary, and then ask each business to send you a letter confirming they removed the fraudulent charges.

- Step #5: Correct your credit report – victims of identity theft have the right to remove fraudulent information from their credit report. The next step is to write to each of the three credit bureaus. Include a copy of your Identity Theft Report and provide proof of your identity. Explain which information on your credit report is fraudulent and ask them to block that information. Use the FTC’s sample letter if you need help.

- Step #6: Add an extended fraud alert or credit freeze – consider placing an extended fraud alert or even a credit freeze on your credit report. An extended fraud alert lasts for seven years and limits access to your credit report by mandating that inquiring companies provide proof of their own identity. A freeze goes even further. It prevents any access to your credit report and lasts for however long you want until you decide to lift the freeze.

SIMPLE-BUT-EFFECTIVE STEPS FOR PROTECTING YOURSELF AND YOUR LOVED ONES

IDENTITY THEFT PROTECTION CHECKLIST

Now that you know what identity theft is, what it looks like, and who is most vulnerable, it’s time to learn how to protect yourself from it. Here are some simple steps you can take to safeguard yourself and your loved ones.

- Keep all your personal documents in a safe place. Don’t carry them around with you, especially not your Social Security card.

- Don’t open emails from senders you don’t recognize, and never open attachments. These can be disguised as special offers for things such as weight loss products, miracle cures for ailments, or merchandise at “unbelievably low prices.” Scammers keep coming up with new subjects to hook you.

- Remember that neither your bank or the government will ever ask you to provide sensitive or personal information via email. Messages that look like they are from these institutions are likely “phishing” scams. (More on these next week.)

- Similarly, if you are ever concerned about the credibility of a call or email from any institution, search for their contact information online and ask them to verify whether the message you received is legitimate.

- In short, don’t share personal information (like your birthday, Social Security number, or bank account number) just because someone asks for it!

- Don’t publish the date of birth or death in obituaries. Thieves can use that information to obtain a death certificate, which usually includes the Social Security number for the deceased individual.

- Collect your mail every day. Place a hold on your mail when you’re away from home.

- Shred all your receipts, credit card offers, account statements, expired credit cards, and other sensitive documents. This prevents dumpster divers from getting your information.

- Regularly review your credit card and bank account statements. Compare receipts with account statements. This can help you find unauthorized transactions.

- Review your credit report annually for discrepancies. If your credit has dipped without any good reason, investigate immediately.

- Install firewalls and malware-detection software on your computer and mobile devices. (More on this next week.)

- Don’t reuse passwords! Every online account should have a different password. Furthermore, change your passwords regularly, and don’t leave them all in one place. You can use a password manager like 1Password, Bitwarden, or Dashlane to help keep track of all your passwords.

Have you ever uttered the words “oh that won’t happen to me”? That’s what we all think, until – IT HAPPENS TO US. Statistics show that 1 in 3 U.S. adults will experience some sort of identity theft in their lifetime. So that makes me 99.9% sure that even if you aren’t affected by identity theft, someone you know will be.

Here’s what I recommend…I know this is a lot of information to process – you don’t have to read it, just book mark the page. Then when it does happen to you or someone you love; you can revisit the information or share it with your loved one. It is stock full of great info and great resources you don’t want to lose.

If you or a loved one has experienced identity theft recently, give us a call – we can help you or them walk through the process.

#2ndHalfWealth 1-05054319 03/31/2022

Disclaimer: Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Sources: This material was prepared by Greg Young and Bill Good Marketing