Each year, Social Security updates your Social Security statement. It is loaded with important information that you should take the time to review regularly (at least every 3 years). Here are several of the items you should focus on.

Each year, Social Security updates your Social Security statement. It is loaded with important information that you should take the time to review regularly (at least every 3 years). Here are several of the items you should focus on.

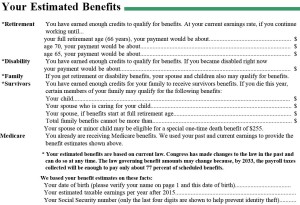

How much will you get when you retire?

Every year, Social Security estimates how much you will receive if you claim benefits at three different ages: full retirement age (FRA), age 62, and age 70. The full retirement age is 66 for most baby boomers and 67 for everyone born in 1960 or later. The longer you wait to claim benefits (up until age 70), the more you get each month. Over time, the difference can be many thousands of dollars. The statement will also let you know if you have worked long enough to qualify for benefits.

How much will you get if you become disabled?

Your Social Security statement will tell you the benefit amount if you become physically disabled in the coming year.

How much will my family get if I die?

Social Security pays benefits to families when you pass away. Your dependent children and spouse caring for those children will be eligible for payments upon your death, and the amount they will get is on your statement. There are also benefits for your widowed spouse.

How much have you earned over the years?

Your statement lists every year you have worked and how much you earned. Your top 35 years of income are used to calculate your retirement payout.

Check these numbers each year for accuracy; sometimes they are not recorded correctly.

How much have you contributed to Social Security and Medicare?

The total amount you paid into Social Security and Medicare throughout your career is listed. An interesting fact, however it is not very important if you are checking your yearly amounts.

Here is how you can find the online statement.

Social Security statements can be complicated. Review them carefully. If in doubt, we suggest you get help from a financial professional who understands Social Security.

As always, we are here to help create your Best 2nd Half.

Contact us by email or call the office at (719) 630-0600 to set up an appointment.

See the index showing all of our Social Security Strategies and Tips.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All illustrations are hypothetical and are not representative of any individual’s specific situation. 1-421874 9/26/2016 #2ndHalfWealth