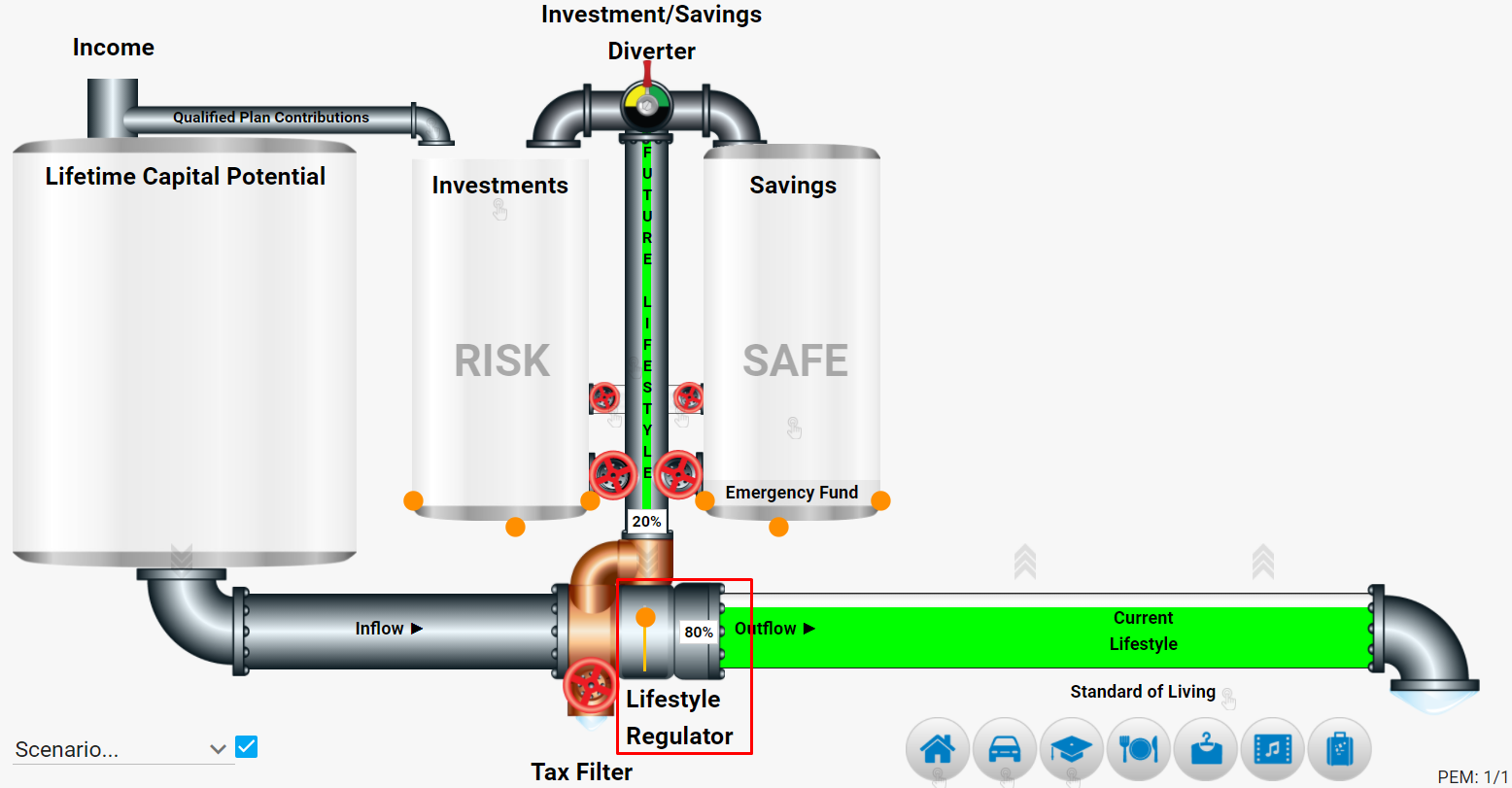

The Lifestyle Regulator

Everyone’s current “lifestyle” is sacred. No one ever wants to consider reducing their lifestyle.

The Lifestyle Regulator may be the one piece of the model that plays the most important role of all in how you manage your money. It regulates the amount of money that you allow to flow through the regulator through to your current lifestyle. It’s the amount you spend today and how much you pump up the Future Lifestyle Tube into your Savings and Investment Tanks to be spent in the future.

Unlike the Tax Filter, this is a valve that you control. As you open the valve, it will allow more money to be consumed with your lifestyle expenses. As you close the valve, it will push money up the Future Lifestyle Tube into the Savings and Investment Tanks to be put away for your future.

Your job is to balance your current lifestyle desires with your future lifestyle requirements.

Many look to financial service professionals to help them manage their money, which is a good thing, especially if you have little skill in this area. Unfortunately, many advisors are only concerned with helping you find a place to put your money rather than helping you with strategies to help you find money you may be losing unnecessarily.

Some advisors only focus on the yellow tank or Investment Tank, and some only on the green tank or Safe Tank. You will need someone to handle the money in the Investment Tank to oversee your investment dollars who can maximize your return potential. We look at this as the offense. You will also need an advisor to help you with the Safe Tank to help you move the ball down the field, putting you in control of the game again. Again this is offense.

Finally, you need some special teams coaches like your Property and Casualty agent, CPA, and attorney to make sure you have the proper protection in place with the right players on the field. This is defense. My job as head coach is to give you direction in every area of your financial model. It is not necessary or even probable that one person will be licensed to help you in every area I mentioned. For example, I am not a CPA or an attorney. As head coach, I specialize in a few areas and will recommend other coaches to help you in other areas.

Your job is managing the amount of flow through your Lifestyle Regulator with a solid understanding of the Personal Economic Model. You will feel more confident when discussing strategies.

Another valuable role the Lifestyle Regulator plays is that it will provide you with the answers to four questions you need to know to determine what you need to do today to be able to live like you desire in the future.

The four questions are:

- Do you know what rate of return you’ll have to earn for you to be able to live in the future like you live today, adjusted for inflation and have your money last to your life expectancy?

- Do you know how much you should be saving each month or annually to make sure you’ll have enough set aside to live like you live today adjusted for inflation?

- Do you know how long you’ll have to work before you can retire and have your money last to your life expectancy?

- Do you know how much you’ll have to reduce your standard of living if you don’t do something different to avoid running out of money before your life expectancy.

Obviously, learning the answers to these four questions will give you the insight you need to make better informed decisions about your finances. We will cover these questions in greater detail when we begin to look at different pieces of the model.

Don’t want to wait to get your 4 Questions answered? Schedule a call with me, I love discussing these questions with my friends and clients! It’s why I’m in the business I am – it’s my passion!