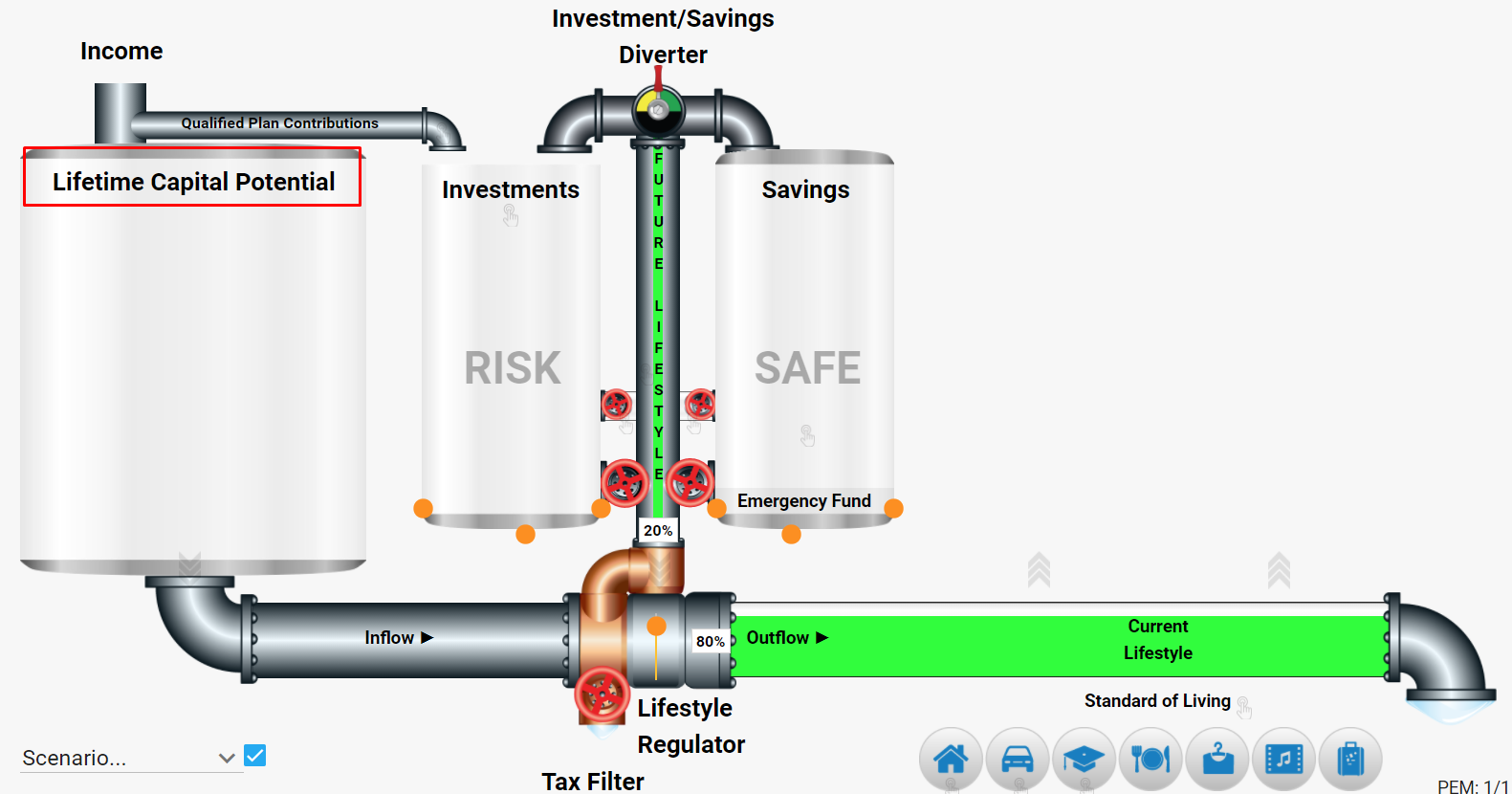

If you read my email last week, you learned that I’m starting a new segment called “Coach’s Corner”. Last week, I told you I would cover the Personal Economic Model (PEM) in more detail. So let’s get to it…

The importance of the big tank illustrated on the left side of the model is to signify that over your lifetime, you will have a great deal of money flow into and through this tank (Lifetime Capital Potential).

You may not think you make much money, but when you consider the total dollars you will earn over your entire lifetime, it takes on a different meaning. You probably never thought about your paycheck or salary this way.

Let’s suppose that on your first day on the job, you received a check for all the work you would do during your entire life. As you read that line, if you’re like many I work with, your first thought was: I’d never show up for work again.

For sake of making my point, let’s say that’s not an option. Okay, so let’s say the check you would receive would be for $5 million, and you can’t earn any other income and you can’t earn any interest. You basically have an ATM machine in your house that you can take money from but can’t put anymore in. As you take money from the machine you would see your balance going down with each withdrawal.

Would you look at that money differently than you look at the money you get each pay period? I am sure you would.

The point is that you need to understand the value of every dollar you receive to make solid financial decisions that will allow you to be as efficient as you can, avoiding unnecessarily losses along the way. Since the money that will pass through your hands is finite, it demands that you maximize the use of every dollar. Begin your financial planning with the end in mind.

It is our desire for you to see your financial future from the beginning to the end, should you study the Personal Economic Model. Knowing what you need to do today to ensure that you’re prepared for the future will have a positive effect on your financial life both today and tomorrow. The average American is not doing what they need to do to live like they live today in the future – on top of that they often forget to adjust for inflation.

If you wish to be financially where you want to be, you will need to do what others are not willing to do. Notice earlier, that I mentioned “the average American”. Well, we both know YOU are not average; you are extraordinary! So, give me a call, and we’ll make sure you are where you need to be!