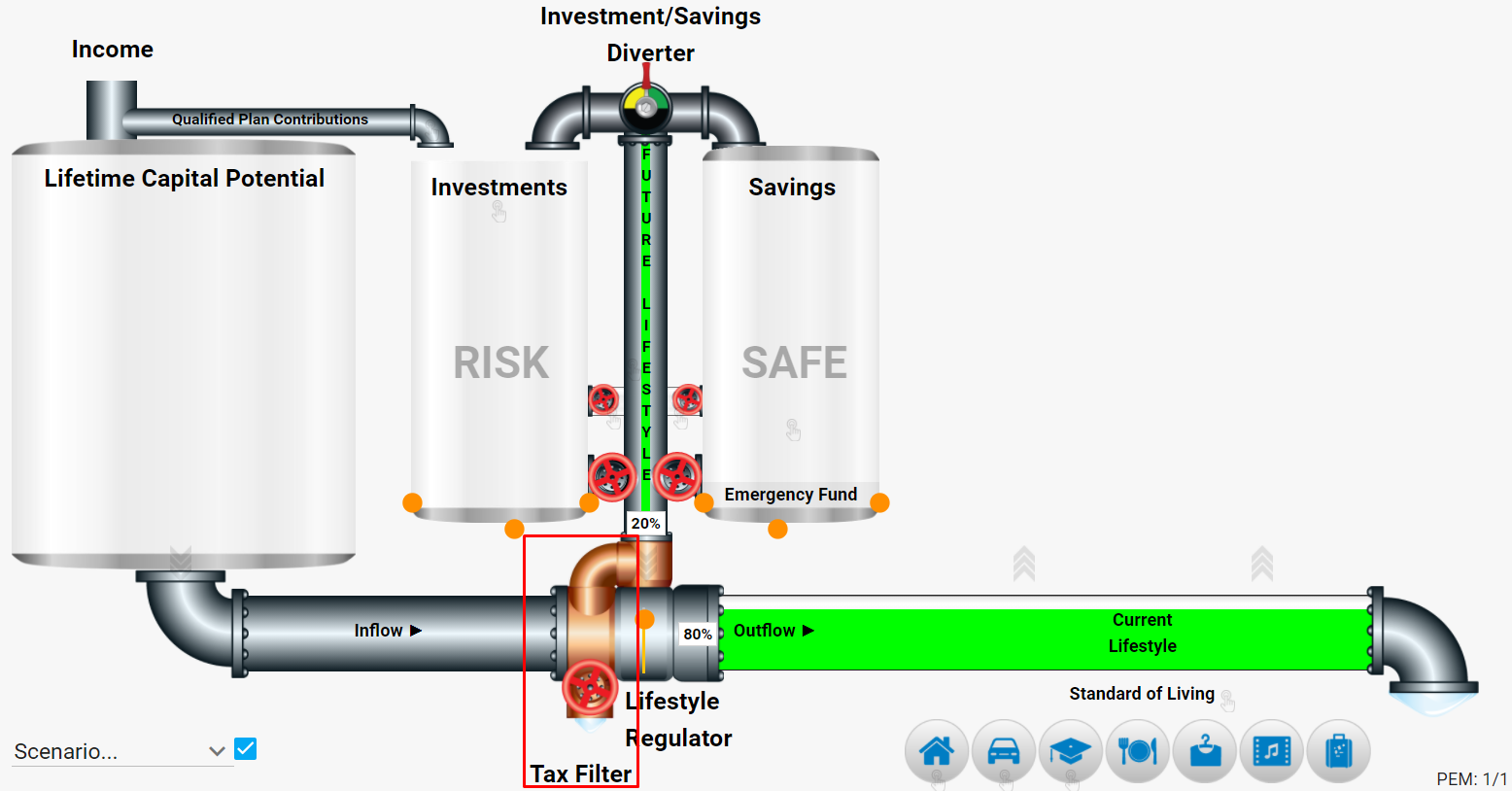

As promised last week, this week in Coach’s Corner we’re going to discuss the tax filter…so let’s get right to it.

The Tax Filter

If you focus your attention on the copper tax filter (shown in the red box above), you will notice it takes center stage in the model. Every dollar will eventually flow through the tax filter by the federal and state governments. They can extract the money they require to handle their operating expenses and civic responsibilities.

There’s an option to avoid paying taxes initially on income coming in the model through contributions to qualified retirement plans, where the government allows you to postpone your taxes until your retirement, at which time you will be taxed when you withdraw the money. I will cover qualified plans a bit later.

Until then, as you think about your money passing through the tax filter, how many times do you want it to go through this part of your financial model? Some things you do require your money to pass only once, while others can require you to be taxed over and over every year. Minimizing unnecessary tax loss can have a big impact on your cash flow and your financial future.

I believe the tax filter will soon play a more offensive roll in your life. One of my favorite sources, Brian Wesbury, Chief Economist at First Trust, just wrote, “Bargaining on tax hikes has already started in Washington, at least behind the scenes. It’s going to be a long process, but we can say with high conviction that taxes are going up … and will likely be implemented on January 1, 2022.” They only tax the folks with money and more than likely if you’re reading this that includes you. We knew the Trump tax cuts wouldn’t last forever. I’ve been talking about this since those were implemented. You can read the rest of Brian’s thoughts and signup for weekly updates at his blog.

What do we need to change in your case to lessen your future taxes?