By now, you are probably familiar with the segment I am calling Coach’s Corner. (If not, check out March 11th’s and March 18th’s post.)

This week, we’re going to cover:

Monthly Cash Flow

This is something that needs little explanation. Most live from month to month. Our fixed expenses are paid monthly, and our discretionary spending is determined by how much we have left over after we have paid the bills.

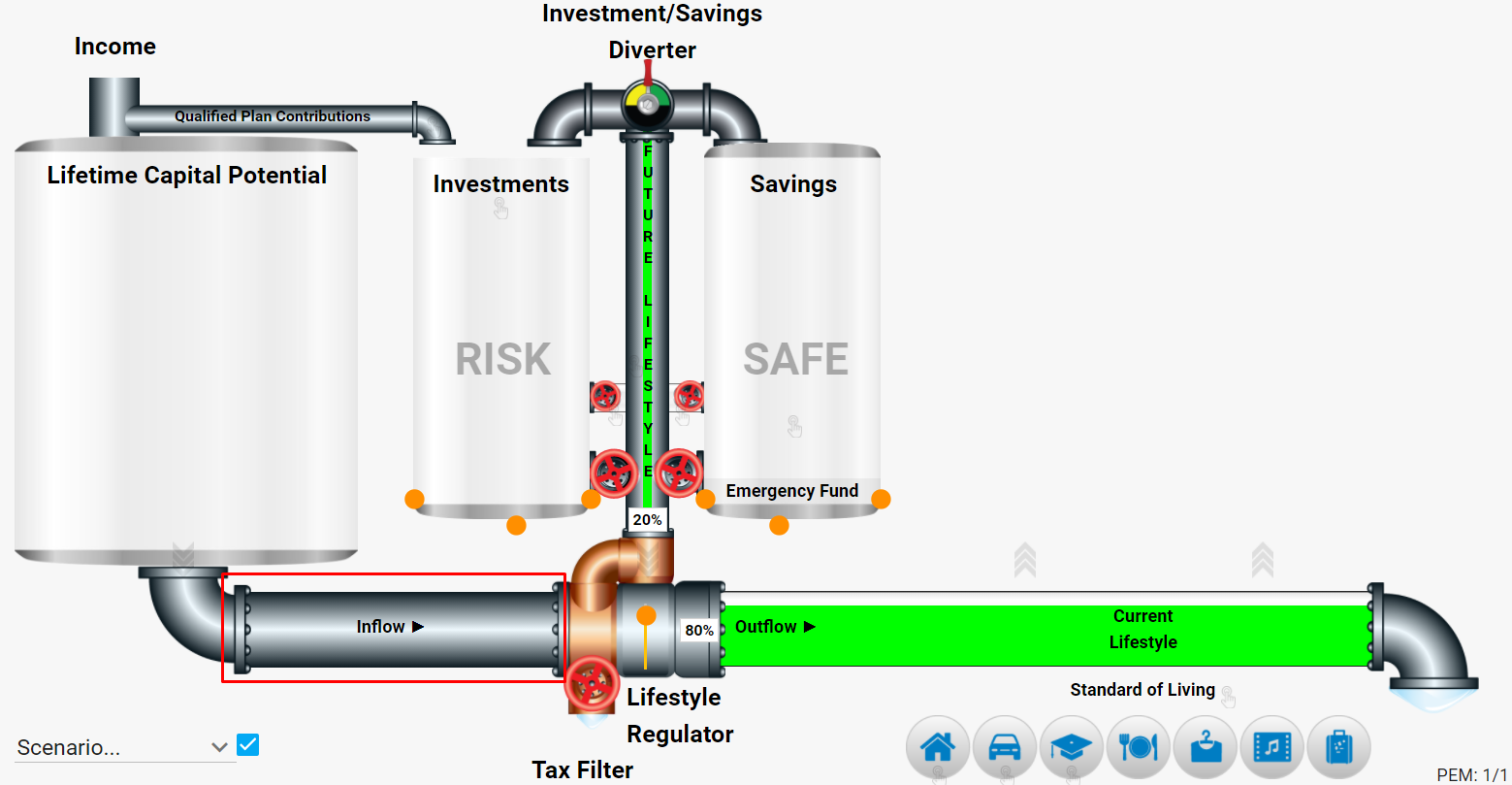

Most Americans do not receive their monthly cash flow until it is passed through the “tax filter” where the state and federal government have taken taxes due on their earnings. Most of us have taxes taken out of our payroll check, while others pay quarterly, and some not until they are normally due around April 15.

When thinking about your monthly cash flow, it is best to think of it in terms of after-tax cash flow, your bring-home pay after tax. When we get a job and they tell us what our gross annual salary will be, we don’t really think in net terms – that we will only get 70% or 80% depending on our tax rate.

You may make $100,000, but you can’t live the lifestyle of someone that has $100,000. Well, you can, but that causes a whole other set of problems ? Remember that every dollar you earn must pass through the tax filter, which will reduce the amount of spendable income available. Not withholding taxes can cause a tremendous cash flow problem if the money is spent and you have nothing left to pay your taxes.

The thing to consider is how much money you get to spend, not how much money you make. Remember that you have a “partner”, and I’m not talking about your spouse. I’m referring to the federal government. They must be paid before you have money to spend. You normally can’t escape the tax man. There’s a penalty for not paying your taxes…it is five years in the federal pen (well not really, but the penalties can be quite painful).

So, the tax law does require you to pay what is owed…but not a penny more. It’s like drawing a line in the sand – you want to get right up to the line, but not go over it. It sounds easy but ask any CPA – they will tell you just how exhausting and painful it can be to find that line. You have to be well trained and diligent.

Do you know where your line is? If not, give me a call and let’s chat. I can give you a referral to a CPA and we can discuss other tax saving strategies.

In either case, come back next week to hear more about the “Tax Filter”.