March Madness and Investing

Although I don’t watch much basketball during the season, I enjoy the playoffs and championships. It’s always a pleasure to see great competition.

I was reading about the bracket process and was struck with how similar it is to the investment process we use.

Seeding

Madness, specifically “March Madness,” has begun. The tournament begins in earnest with 64 teams and operates in a single-elimination format, meaning that 63 games will be played to determine the national champion.

While personal college affiliations are of course important, it is the office pools and bracket challenges that drive the interest in this event for many. In bracket scoring, there is no reward for our favorite team “hanging in there” against a major conference powerhouse, and style points are not awarded in the final tabulation. Participants simply need to pick which teams will win each of the 63 games, which is no easy task (!) – estimates of the odds of picking a perfect bracket (i.e. correctly picking the winner of all 63 games) range from one in 128 billion to one in 9.2 quintillion. Fortunately, the NCAA brought March Madness into the casual fans’ wheelhouse by including seeding the teams, helping us all move one step closer to being “bracketologists.”

The seeding process of teams began in 1979 as a way for the NCAA to make sure that the strongest teams didn’t end up meeting each other too early in the tournament, which would be a threat to TV ratings and the overall fan experience. The seeding also provides the uninitiated a basis for picking winners; because while there are few who have likely followed the seasons of all 64 teams from around the country, everyone intuitively understands that picking a number 16 seed (the lowest ranked teams) to beat a number one seed is not a statistically good bet.

In fact, prior to last year’s tournament, a number one seed had never lost to a number 16 seed. Last year, however, the University of Virginia earned the dubious distinction of becoming the first number one seed to do so when they were defeated by the largely unknown University of Maryland, Baltimore County 74 to 54, making UMBC the first number 16 seed to ever make it beyond the first round of the tournament. The Retrievers didn’t defy historical statistics for long, however, as they fell to the number nine seed Kansas State in the second round.

A team with a high ranking is, after all, the stronger team based upon qualitative and quantitative evaluation. They often possess more talent and better coaching than the lower-ranked teams, especially when comparing teams with a large gap in seeding. While past performance has certainly not guaranteed future success for all of the high-seeded teams, it is certainly a good starting point for the average fan’s tournament bracket.

The seeding process has largely worked out as the NCAA intended it to. Higher ranked teams typically advance through the early rounds, leading to exciting clashes of talented teams late in the tournament.

Other Interesting Observations (1985-2016)

-

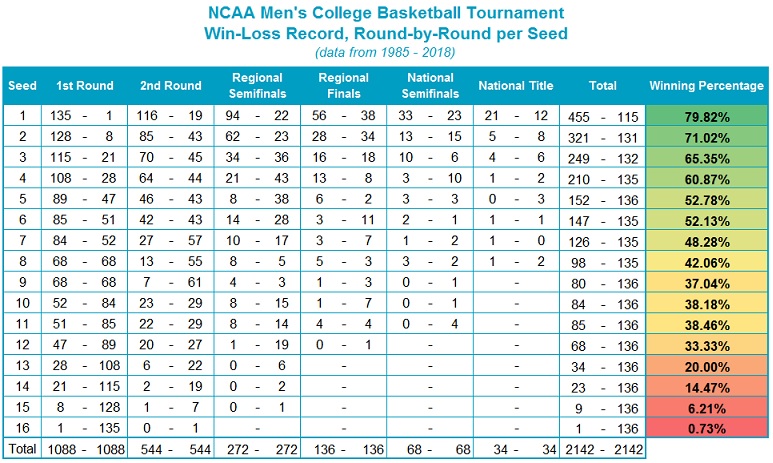

- Number-one-seeded teams have won the greatest percentage of games, at 80% (79.82%)

- Top-three-seeded teams have combined for a record of 1025 wins and 378 losses, a winning percentage of 73.06%.

- By contrast, the bottom-three-seeded teams (14-16) have a combined win, a total of just 33 games (or 7.48% of their contests) in 34 years.

- Top-five-seeded teams have produced a winning percentage of 68.12%, while the bottom five have won just 16.56% of their games.

- Top-seeded teams have won more games in tournament history than the bottom three seeds have played (455 to 441).

- The National title has been won by a team with a #4 seed or higher in 31 out of the 34 years.

How We’re Like the NCAA (Not Madness)

While the NCAA committee has their own proprietary ways of ranking teams, the input is based upon head-to-head games earlier in the season and overall recent performance.

In our investment process, we are simply “seeding” teams, and like the NCAA experts, we are seeding them based upon their success against their peers.

Also, like the NCAA tournament, we know that history shows those top seeds perform better as a universe than the lower seeds. There are upsets, of course, but the trend favors the higher seeds and so that is where we focus our investment.

These same principals can be applied to the markets, with the 64 teams represented by the broader market. As this group of stocks and funds (many more than 64) works its way through the season, many stocks and funds will behave quite similarly. However, there will be funds, sectors and classes that break away from the pack for sustained periods of time, others that fall well behind the pack. This leads to our proprietary investment “seeding” process.

One metric that has a history of providing a quantifiable, objective measure of performance is price. Everyday stocks and funds compete and the results of these competitions are recorded. By recording the results of this daily competition, we can rank stocks, funds, sectors, and even asset classes by relative strength. From this we develop an objective picture of the market competition as it develops, allowing us to see which areas are currently leading, much like we can see in the NCAA seeding process.

As always, we will continue to monitor your portfolios, and make any necessary changes as leadership changes within the market. If you would like to become more familiar with my investment process and the tools I use to identify market leadership across major asset classes and within asset classes, please contact me at your convenience.

The Point Is To Not Overreact

There will be winners and losers. There will be upsets. Some records matter. Some don’t. And the stories they tell can be very subjective. That’s why we don’t overreact to them.

Here’s what we do instead:

- We continue with our strategy; identifying the funds, sectors, and asset classes that have the strength to move beyond the pack.

- We don’t allow ourselves to flinch at every market wobble.

- Our investment strategy is not based off headlines, storylines, records, or milestones.

In the meantime, if you’re worried about what will happen when this bull market ends, that’s okay. Just focus on what you can control. Focus on paying off your house, setting up an emergency fund, or helping your children or grandchildren pay for college. Take care of the things that matter now.

Human beings tend to be obsessed with setting records. But here at Wealth Advisors, our job is to help you set goals – and then work toward achieving them. Whether we’re in the longest bull market or not, that’s what we intend to do.

As always, if you have any questions about the markets, or about your portfolio, please let us know!

#2ndHalfWealth 1-833713

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss.