The PEM Can Help

I am starting a new column today on ideas about money, income, risk and debt. It relates to some of the tools we use. Some of these ideas you may have heard. Others maybe not. We’ve decided to call the column Coach’s Corner. I hope it will be thought provoking and cause you to think differently about money and your current and future financial plans.

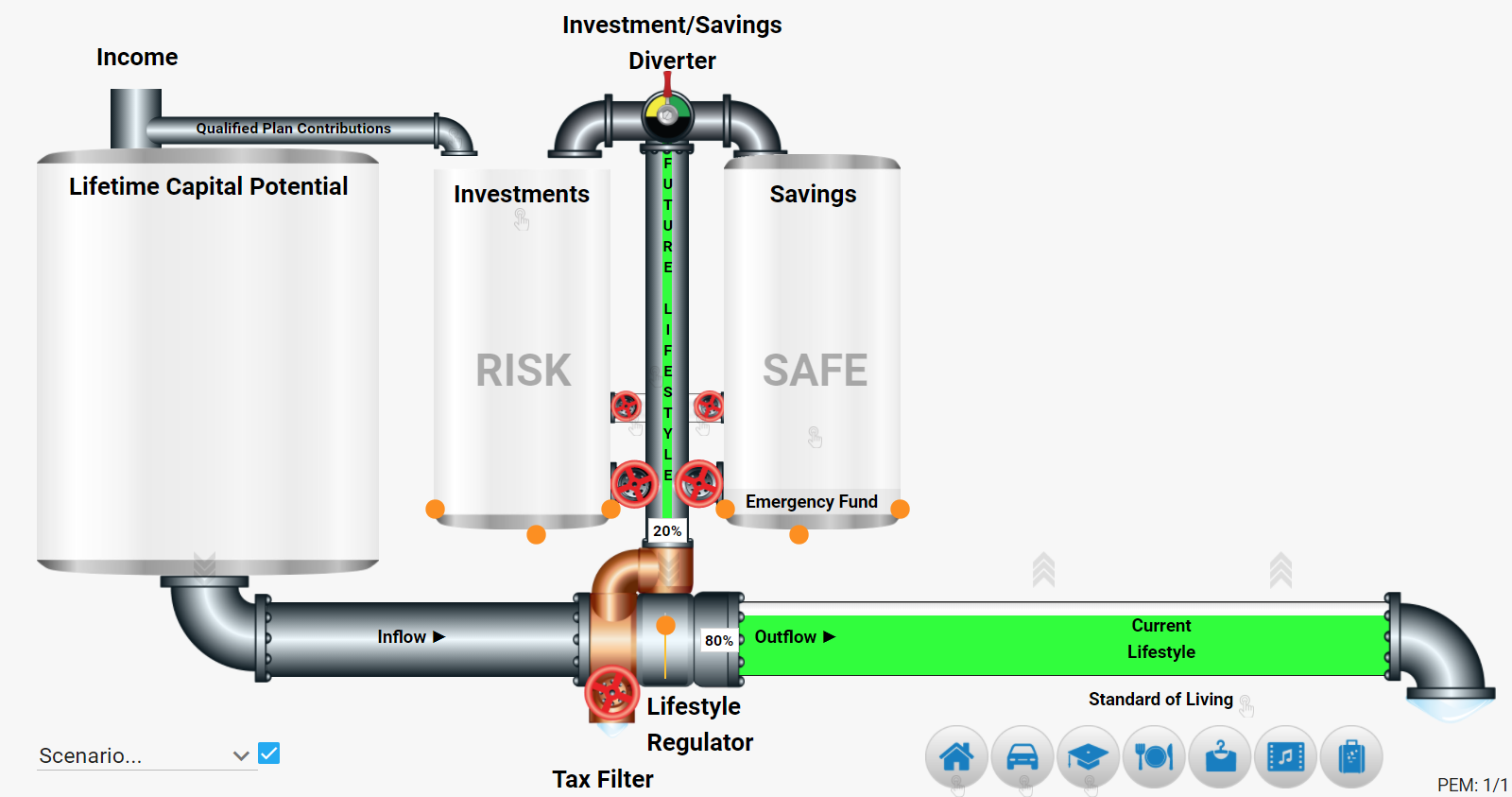

A PICTURE IS WORTH A THOUSAND WORDS

Today I want to introduce you to the Personal Economic Model or PEM. At first glance, it does not look like much more than something you might see in the basement or mechanical room of your home. You’ll quickly notice a series of tanks – and tubes connecting the tanks – labeled with terms that convey something to do with money. The Personal Economic Model is a cash flow picture of what happens to your money. I’ve shared this with some of you and others may have never seen this picture before.

Let’s begin with a simple question: What do you want your financial future to look like?

Let me make it even easier. Finish this sentence:

I want my future standard of living and lifestyle to be: _________________________________________

A – better than it is today.

B – at least the same as it is today.

OR

C – worse than it is today.

If you are like most people, you probably answered A or B. I’ve never had anyone answer C, so if you did – call me. I want to hear your story!

The Personal Economic Model is a cash flow picture of what happens to your money. I’ve shared this with some of you and others have never seen this picture before. It should be obvious that if you’re going to live the same or better in the future, than you do today, you’ll need to find a balance between the money you spend on your current lifestyle desires and the money you put away for your future lifestyle requirements.

Understanding the Personal Economic Model will help you design a plan to live life today to the fullest while keeping in mind what you need to do to secure your future lifestyle. Getting your financial life together takes thought and discipline which many consider painful. I understand that you will experience pain to get your finances in order, but it will most likely be more painful if you do nothing.

It has been said there are two types of pain:

- The pain of discipline and/or

- The pain of regret.

It is up to you to choose which of the types of pain you want to live through.

If you’re saying to yourself – tell me more about this Personal Economic Model…

Tune in next week, I’ll cover it in more detail.