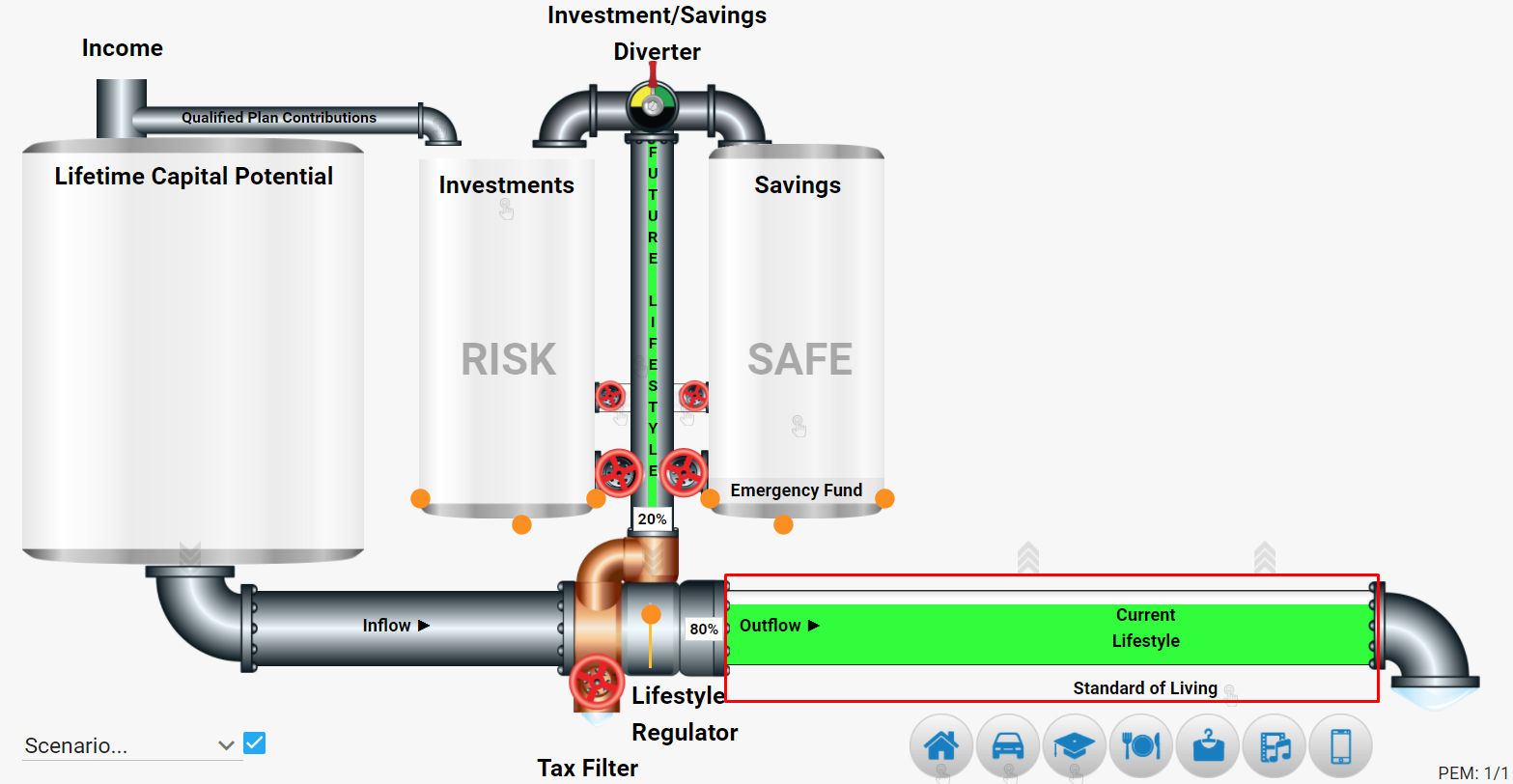

Current Lifestyle Tube

This tube supplies the cashflow necessary for you to pay for all the things that make up your standard of living. Those things could include cars, house, education for your children, food, clothing, vacations, entertainment, and everything else we spend our money on that we call life.

This tube supplies the cashflow necessary for you to pay for all the things that make up your standard of living. Those things could include cars, house, education for your children, food, clothing, vacations, entertainment, and everything else we spend our money on that we call life.

The key thing to understand is this is the natural flow for your money and ANY money that flows through this tube, once spent, is gone forever.

There is only one current lifestyle expense that has the potential to return money once spent, and that is the money you spend to buy your house. Many consider the money in their house to be their best investment. I don’t consider your house an investment because in order for you to have access to the equity, you would need to sell your house or borrow against it. You would then need to find another place to sleep.

In order for you to make money where you sleep, you must be able to sell your house at a profit, which may be more challenging than you realize when you consider all related expenses, such as property taxes, homeowners insurance and maintenance. When you factor in all the expenses you spend on where you sleep, you may have a new understanding of why we have your house listed as a lifestyle expense rather than investment.

For many, your house and the decisions required to pay for it will most likely be your greatest single expense. This is one of the top five areas where potential wealth transfers can incur unknowingly and unnecessarily.

I will share more on this in the future.

Don’t want to wait? Schedule a call with me, I’d love to talk with you in more detail about your specific circumstance! Each person’s story and experience is unique, so let’s come up with your own 2ndHalf strategy!