When it comes to investing, there’s a lot of terminology and jargon you might see bandied about by financial professionals or the media. Most of these terms are not hard to understand – but they may seem baffling at first glance.

Understanding some basic investing terms is helpful, because it can help transform investing from some arcane art into a simple process. And the more you see investing as a process based on rules and logic, rather than something based on emotions, the more likely you will find success.

One important term every investor should understand is asset allocation.

Improper asset allocation is one of the most common mistakes an investor can make. Why is asset allocation so important? Look at it this way: If you were to eat only one food every day for your entire life, your body would be very unhealthy. If you were to exercise only one group of muscles for your entire life, your body as a whole would be very weak. And when you invest all your money in the same way, the same could be true of your finances.

Asset allocation is basically a strategy that spreads your investments across different “asset classes.” The three main classes are equities (stocks), fixed income (bonds), and cash. There are other classes, of course, like commodities and real estate. And there are sub-classes as well. For example, “stocks” can be divided up into many different classes, like international stocks, small, mid, and large-cap stocks, etc.

We monitor each of these asset classes (and others) and attempt to allocate to where the strength lies in the market.

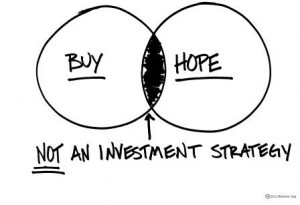

For years the “buy and hold” (buy and hope!) method of investing has been the rule of thumb for many investors. Today’s economy and globalized markets have created increasingly volatile up and down cycles, making “buy and hold” a thing of the past.

Many investors approaching retirement don’t have time to wait for their assets to recover from losses, and withdrawing assets during a down cycle can be a very painful experience. Our Advance & Protect Strategy is intended to capture growth when the market is rising and protect capital when the market is falling.

As investment analyst Louise Yamada said, “There are two kinds of losses. A loss of capital and a loss of opportunity; but there will always be another opportunity if you protect capital.” We are very conscious of trying to protect your money during times of anticipated increased volatility or negative trends. That way, we will have capital to invest when new opportunities arise.

Wealth Advisors’ Advance & Protect Strategy is a tactical total return strategy. It seeks to secure gains in advancing markets and protect capital in negative markets. Our emphasis is on risk management and protecting irreplaceable capital. Whether retirement is on the near horizon (or you’re currently enjoying a great 2nd Half) there’s no time to allow for dramatic capital losses.

No strategy assures success or protects against loss. Investing involves risk including loss of principal. Past performance is no guarantee of future results. There is no way to determine the right time to enter or exit the market. Technical analysis is based on the study of historical price movements and past trend patterns.

There is no assurance that these movements or trends can or will be duplicated in the near future. It logically follows that historical precedent does not guarantee future results. There is no assurance that the investment objective of any investment strategy will be attained. An investor trading in stocks according to an Advance & Protect strategy may incur greater transaction costs than if the investor follows a Buy & Hold strategy.

If you’d like to talk about our current asset allocation, give me a call.

Have a great week!