On May 1, the Secretary of the Treasury informed Congress that the U.S. could default on its debt by June 1 if legislators do not raise the nation’s debt ceiling.1

Here we go again! This announcement was not a surprise.

The U.S. officially hit the debt ceiling in January but were able to stave off any immediate effects through the use of “extraordinary measures.” (These are essentially accounting tools the government can use to pay its bills without authorizing any new debt.) The Secretary’s recent message was to let Congress know those measures are close to being exhausted. Without raising the debt ceiling, the U.S. will not have the money it needs to pay its debts. And while the exact date this will happen is unknown, it could come by June 1 at the earliest.

Should a default actually happen, the economic consequences could be severe. But even if Congress staves off the unthinkable, simply going down to the wire can have negative effects on the markets. To explain why that is, it’s useful to first remind ourselves what the debt ceiling is.

The debt ceiling is “the total amount of money that the government is authorized to borrow to meet its existing legal obligations.”2 What are these obligations? It’s a massive list. Think Social Security and Medicare benefits, for starters. Tax refunds, military salaries, and interest payments on Treasury bonds are hugely important, too. The debt ceiling, then, is the limit to what the government can borrow to pay back what it has already spent. (Or is legally obligated to spend.)

Normally, raising the debt ceiling requires a simple act of Congress. But in some years, politicians disagree about whether the ceiling should be raised without an accompanying decrease in spending. That’s the scenario we’re in right now. Congressional Republicans do not want to raise the debt ceiling without enacting spending cuts at the same time. Democrats, meanwhile, prefer a “clean” hike where the ceiling is raised without conditions. In their view, any changes to federal spending should come separately, after the nation’s existing debts are addressed.

In other words, the two sides of the political aisle are engaged in a game of fiscal “chicken.” Each betting the other will blink first.

While no one is quite sure what will happen if the U.S. defaults – it’s never happened before – it’s not hard to guess, either. Look at that list of obligations I mentioned earlier. Now, imagine if they all just…stopped. No Social Security checks. No Medicare payments. No tax refunds. Tens of thousands of soldiers and government employees without income. And don’t discount the importance of interest payments on Treasury bonds. Without this, interest rates would skyrocket and probably lead to a major recession.

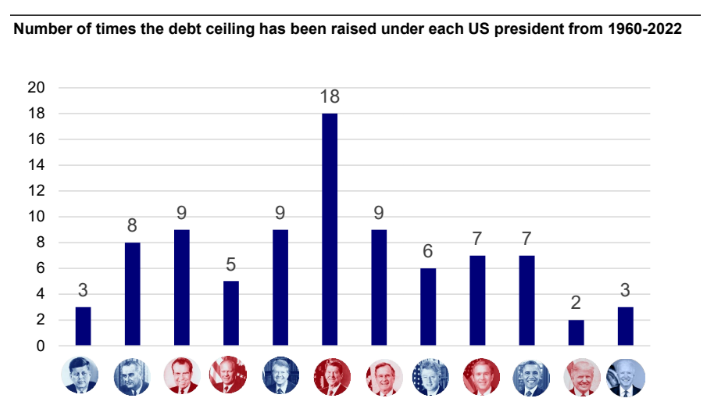

Now, it’s important to note that this is not our country’s first rodeo with the debt ceiling. This has actually happened several times over the past twelve years. In each instance, Democrats and Republicans eventually came to an agreement and raised the ceiling. Most experts expect the same thing to happen this time.

That said, the two sides are still very far apart. While House Republicans have made a proposal on the cuts they want to see, most are measures that Democrats are unlikely to agree to. (The bill would lift the debt ceiling by $1.5 trillion through March of 2024 while eliminating $130 billion in government funds. But that’s not a very long time, and most of the cuts are to areas that the White House considers high priority.3) The two sides have agreed to a meeting on May 9, but it’s doubtful whether that will lead to anything.

The closer we get to June, however, the more nervous Wall Street will get. Given how much uncertainty already exists in the markets – thanks to rising interest rates and a recent spate of bank failures – a debt ceiling crisis is the last thing investors need. To be sure, there are other possible outcomes to this situation. Perhaps the most likely is that Congress enacts a short-term increase to the borrowing limit. This would give themselves more time to pass something longer lasting. It would also be seen as kicking the can further down the road…and not much further at that!

If the U.S. does default, there may be ways to blunt the impact. For instance, the government could prioritize its debt payments so that not everyone gets left out in the cold all at once. Another possibility would be for the Federal Reserve to buy up more Treasury bonds. This would at least stabilize the bond market. But none of these options are ideal, and it would be best for everyone to avoid them.

So, that’s where things stand. In the coming weeks, I’ll send you more detailed information on what hitting the debt ceiling could mean for investors. (Assuming Congress doesn’t get its act together before then.)

As always, please let me know if you have any questions, or if there is anything I can do for you!

#2ndHalfWealth 1-05369539 11/30/2024