Our four-step process to work toward this goal

#1 – We closely monitor market trends and rotation in sectors and asset classes.

#2 – Using technical analysis, we monitor metrics such as price, relative strength and volatility – which help to reveal entry and exit points.

#3 – Based on these tools, we employ a strict buy and sell discipline which is the foundation of the Advance & Protect Investment Strategy™.

#4 – We monitor each portfolio component on a daily basis and adjust your allocations within your managed accounts as our rotation strategy provides and market cycles evolve.

By monitoring market trends and adjusting your allocation accordingly, our Advance & Protect Investment Strategy™ strives to more effectively manage risk and help protect your investments from today’s extreme market volatility.

Protecting Capital

Ongoing turmoil in worldwide financial markets has reiterated the need for diligent risk management. Our managed accounts allow us to more effectively monitor the risk level in the market. When we believe the risk is too high, we have the capability to take action to try to mitigate that exposure on your behalf.

As investment analyst Louise Yamada said, “There are two kinds of losses. A loss of capital and a loss of opportunity; but there will always be another opportunity if you protect capital.” We are very conscious of trying to protect your money during times of anticipated increased volatility or negative trends. That way, we will have capital to invest when new opportunities arise.

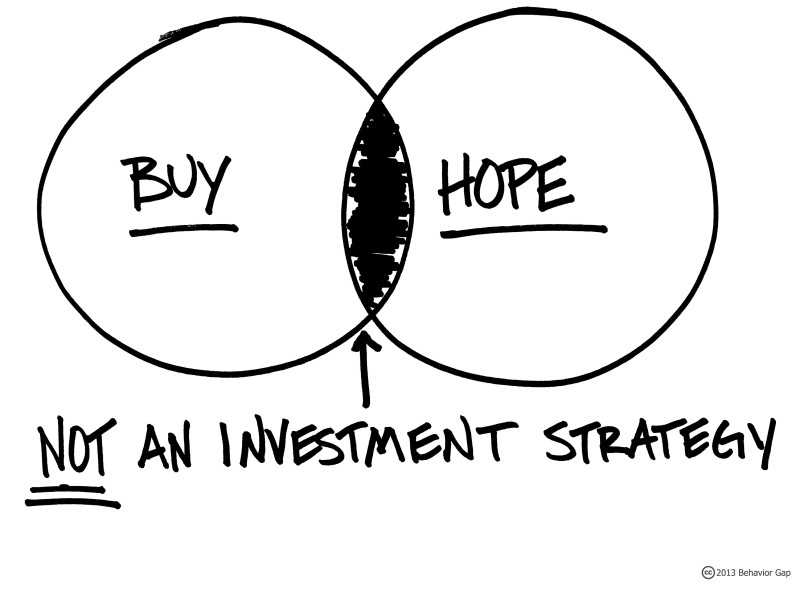

Buy and Hope Has Failed Too Many

Wealth Advisors’ Advance & Protect Investment Strategy™ is a tactical total return strategy. It seeks to secure gains in advancing markets and protect capital in negative markets. Our emphasis is on risk management and protecting irreplaceable capital. Whether retirement is on the near horizon (or you’re currently enjoying a great 2nd Half) there’s no time to allow for dramatic capital losses.

No strategy assures success or protects against loss. Investing involves risk including loss of principal. Past performance is no guarantee of future results. There is no way to determine the right time to enter or exit the market. Technical analysis is based on the study of historical price movements and past trend patterns.

There is no assurance that these movements or trends can or will be duplicated in the near future. It logically follows that historical precedent does not guarantee future results. There is no assurance that the investment objective of any investment strategy will be attained. An investor trading in stocks according to an Advance & Protect Investment Strategy™ may incur greater transaction costs than if the investor follows a Buy & Hold strategy.