What is Advance & Protect?

Our investment strategy at Wealth Advisors

As the President of Wealth Advisors, I am passionate about my clients and helping them to pursue their financial goals. I am fortunate to have had a great group of clients for many years. Each client is unique, but most are fairly conservative investors who, like me, place a high value in the safety of their investments and less emphasis on taking unnecessary risk in order to generate higher returns. I desire to avoid short term and high risk trading, and definitely do not follow a “buy and hold” approach. At Wealth Advisors, we constantly monitor the market indicators and tactically manage our investments using an Advance & Protect strategy.

Advance & Protect is a strategy specifically designed and implemented by Wealth Advisors to help protect an investor’s irreplaceable capital in today’s rapidly shifting financial markets.

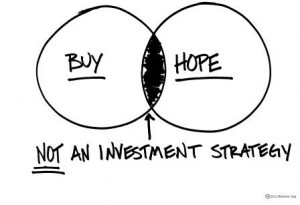

Buy and Hope Has Failed Too Many

In the past, the “buy and hold” method of investing was the rule of thumb for many investors. Today’s economy and globalized markets have created increasingly volatile up and down cycles, making “buy and hold” a thing of the past.

A buy and hold strategy can do well in an up market, since “a rising tide lifts all boats”. However, when the market turns and drops, holding on to assets may not be the best strategy. Many investors approaching retirement don’t have time to wait for their assets to recover from losses, and withdrawing assets during a down cycle can be a very painful experience.

Protecting Capital

Ongoing turmoil in worldwide financial markets has reiterated the need for diligent risk management. Our accounts allow us to more effectively monitor the risk level in the market. When we believe the risk is too high, we have the capability to take action to try to mitigate that exposure on your behalf.

Investment analyst Louise Yamada said, “There are two kinds of losses. A loss of capital and a loss of opportunity; but there will always be another opportunity if you protect capital.” We are very conscious of trying to protect your money during times of anticipated increased volatility or negative trends. With your capital protected during a down cycle, we will be positioned to have that same capital available to invest when new opportunities arise.

Wealth Advisors’ Advance & Protect is a tactical total return strategy. It seeks to secure gains in advancing markets and protect capital in negative markets. Our emphasis is on risk management and protecting irreplaceable capital. Whether retirement is on the near horizon or you’re currently enjoying a great 2nd Half, there is no time to allow for dramatic capital losses.

Our four-step Advance & Protect process works towards the goal of taking advantage of positive market trends (Advance), and stepping aside in a down cycle (Protect).

- We closely monitor market trends and rotate into the most favorable sectors and asset classes.

- Using technical analysis, we monitor metrics such as price, relative strength, momentum, and volatility – which help to reveal entry and exit points.

- Based on these tools, we employ a strict buy and sell discipline which is the foundation of the Advance & Protect strategy.

- We monitor each portfolio component on a daily basis and adjust your allocations within your accounts as our rotation strategy provides and market cycles evolve.

By monitoring market trends and adjusting allocations accordingly, our Advance & Protect strategy strives to more effectively manage risk and help protect your investments from today’s extreme market volatility.

Interacting with many clients over the years, I have found the single most important issue to every client is, “Does my advisor really understand my situation?” At Wealth Advisors, we purposefully discuss your plans for retirement – your Best 2nd Half – beyond money. These are always interesting conversations. It’s like a “last day of life” conversation. It’s important to help you envision all you want to accomplish with your time AND your money. The ensuing relationship that builds allows me to help ensure that each client’s investments are going to the appropriate place. Our Advance & Protect strategy is just one piece of the puzzle to help build a well-planned and executed 2nd Half.

Call Wealth Advisors at (719) 630-0600 to schedule a no obligation appointment and see if Advance & Protect would be suitable for your retirement accounts.

#2ndhalfwealth

7/1/2016 1-396020

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. Technical analysis is based on the study of historical price movements and past trend patterns. There is no assurance that these movements or trends can or will be duplicated in the near future.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.